Endeavor Silver: Valuation finally starts to improve (NYSE:EXK)

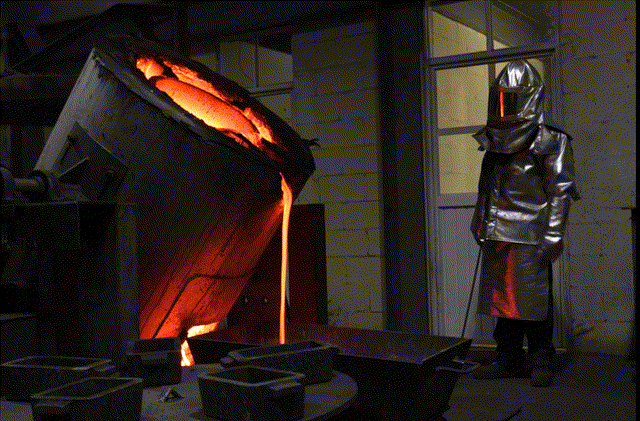

Juan Jose Napuri/iStock via Getty Images

The Q1 earnings season for the Silver Miners Index (SIL) has finally come to an end and one of the first companies to report it was Endeavor Silver (NYSE:EXC). From a headline perspective, the company had a solid quarter with 4% higher production and a significant increase in sales (+68% yoy). However, the latter was fueled by declining inventories and while sales rose, margins fell off a cliff to just $2.58/oz. The silver lining is that some of this negativity appears to be priced into the stock and further weakness below $3.20 should create a buying opportunity from a swing trading perspective.

Guanacevi Operations (company presentation)

About two months ago, I wrote about Endeavor Silver and realized that chasing the stock above $5.30 probably wasn’t a good idea. This was because the company faced difficult comparable pricing year-over-year from a margin perspective and the long-term margin outlook was better due to Terronera; Commercial production was at least two years away. Since then, EXK has been beaten and slipped more than 40%. The poor performance is due to margin compression in the first quarter and an uglier quarter for margins in the second quarter. Let’s take a closer look below.

production

Endeavor Silver released its first quarter financial results last month and reported quarterly production of ~1.31 million ounces of silver and ~8,700 ounces of gold. This resulted in a 25% increase in silver production over the same period last year, offset by a 22% decline in gold production due in part to the lack of contribution from its smallest mine, El Compas, which was placed into care and maintenance. Overall, this represented a 4% increase in silver equivalent ounce (SEO) production over the same period last year.

Endeavor Silver – Quarterly Gold and Silver Production (company records, author’s chart)

Based on the production of approximately 2.0 million SEOs in Q1 2022, Endeavor is ahead of its forecast median of 7.15 million SEOs and is on track to meet and potentially exceed forecast. In fact, management stated that it expects Guanacevi’s high grades to continue in the near future, and the company buys ore from local miners, giving another boost to salary performance. While grades at Guanacevi were down slightly sequentially in the first quarter, they remained above the 300 grams per tonne mark and above the 3 year average.

Endeavor Silver Operations (company presentation)

Costs & Margins

Unfortunately, while it was a solid quarter from a production and sales perspective, inflationary pressures weighed heavily on margins. This was evidenced by the All in Sustaining Cost (AISC) of $20.90/oz for the first quarter, a 5% increase over the same period last year despite higher production and sales. The company noted that there has been a sharp increase in energy costs, sourced primarily from Mexico’s Federal Commission of Electricity, and labor and utility costs have also increased. The only good news is that since Guanacevi and Bolanitos are relatively low-volume operations, the company is more protected from fuel costs than rivals like Coeur Mining (CDE).

Endeavor Silver – All-in Sustaining Costs & Margins (Company Records, Authors Diagram)

Looking at the chart above, we can see that margins fell off a cliff in the first quarter, falling from $7.23/oz to just $1.70/oz. While this is partly related to the weaker silver price over the period ($24.48/oz), it was also impacted by higher costs. Unfortunately, while Endeavor Silver has been saved by this higher cost trend since 2020 due to the sharp rise in the price of silver, this advantage is no longer there. Even if costs remain at a similar level ($21.00/oz) in Q2 2022, we will see a meaningful margin decline sequentially.

Silver Futures Price (TC2000.com)

This is because the price of silver is trading at its lowest level in over 18 months, with silver priced at $23.40/oz quarter-to-date. Unless we see a significant recovery in silver prices in June, I expect Q2 average realized silver price closer to $23.00/oz, resulting in margins below $2.00/oz. This would mean a margin decline of more than 20% on a sequential basis (estimates of $2.00/oz vs. $2.58/oz in Q1 2022), and the decline could be worse if AISC were to come in higher than my estimates ($21.00/oz).

Financial results

Finally, looking at its financial results, some investors might conclude that Endeavor had a stellar quarter, reporting a 68% year-over-year increase in revenue. However, it is important to note that the Company reduced a significant portion of its metal inventory during the quarter with ~1.72 million ounces of silver sold versus ~1.31 million ounces produced. As such, looking at Endeavor’s annual revenue increases isn’t that helpful. While revenue is up after Guanacevi’s better performance, so is its stock count and its margin profile is unlikely to improve in 2023 as costs are expected to top $24.00/oz next year.

Endeavor Silver – Quarterly Sales (Company Records, Author’s Chart) Endeavor Silver Diluted Share Count (FASTGraphs.com, Author’s Notes and Drawing (2022))

valuation

Based on a current share price of $3.50 and with an updated fully diluted share count of ~187 million shares, Endeavor has a market capitalization of ~$665 million. This represents a P/NAV of just over 1.10 after accounting for the Company’s estimated G&A of $60M, net cash of ~$150M and project NPV of approximately $500M. While this figure of ~1.13x P/NAV is the cheapest Endeavor Silver has traded at since Q2 2020, it is important to note that EXK is a very high-cost producer, which is in part its discounted multiple compared to its peers as Hecla (HL) explains. which are less sensitive to silver price weakness. The above estimate also includes Pitarrilla, which is estimated to be worth $100 million to be conservative.

It could be argued that Endeavor will shed its status as a high-cost producer once its high-margin Terronera project comes on stream, with a target of start-up in H1 2024 (assuming funding is timely). While this is a very fair point, Terronera is at risk of cost overruns even if some work has already been completed. As such, I would not rule out further share dilution pending go-live, which means investors cannot rely on the current share count of 187 million shares, particularly given this team’s track record of consistent share dilution.

In summary, Endeavor Silver is finally reasonably valued at just over 1.1x P/NAV, but investors need to be aware of the risks. Those risks are the fact that we could see additional stock dilution over the next 18 months if Terronera goes ahead of budget and its current operations have razor thin margins that will deteriorate further in the second quarter if the silver price falls below 23, $00/oz remains. Against the backdrop of rising costs, I’d rather hold higher margin producers at higher discounts to fair value than Endeavor Silver. As such, I only see the stock as a swing trading vehicle, at least until Terronera is online.

Technical image

While Endeavor Silver is significantly more reasonably valued after its 40% decline, the stock has broken the key support at $3.90. After this technical failure, the stock’s next support level comes only at $3.05 and a new resistance level comes in at $4.10. When it comes to small-cap producers with high costs, I prefer a risk/reward ratio of at least 6.0 to 1.0 to justify entering new positions. EXK’s current reward-to-risk ratio is 1.33-1.0 ($0.60 potential upside to resistance, $0.45 potential downside to support), so I don’t see a low-risk buy point.

EXK Daily Chart (TC2000.com)

For EXK to move into a low-risk buy zone, the stock would need to break below $3.20 where it would have potential upside of $0.90 of resistance and only $0.15 of potential downside of support. However, in a precious metals market where there are several high-quality producers for sale that trade at a discount to net asset value and pay generous dividends, owning Endeavor Silver could represent an opportunity cost. Therefore, although I would consider buying EXK at $3.15 from a swing trading standpoint, I think there are far better opportunities to play in this sector.

Endeavor Silver Operations (company presentation)

Endeavor Silver had a decent Q1 performance, especially given that it struggled with year-on-year comparisons with two operating mines compared to three in the year-ago period. However, inflationary pressures are a very real concern and while a strong silver price could briefly bail out Endeavor in 2021 and the first quarter of 2022, the second quarter will not. In fact, Q2 could be a very ugly quarter, with AISC margins expected to be below 10%. The good news is that some of this negativity appears to be priced into the stock and further weakness below could present a buying opportunity. In conclusion, I see EXK as a speculative buy at $3.15.

Comments are closed.